Image may be NSFW.

Clik here to view.

New Tax Law, Same Old Question: What’s the Best Entity for Your Business

The Tax Cuts and Jobs Act of 2017 (TCJA) made some of the most consequential changes to Image may be NSFW.

Clik here to view. business income taxation in decades. With a new, significantly lower and flattened corporate tax rate, reduced personal rates, and a 20 percent deduction for income from flow-through entities, the act altered several variables in the equations that executives use to determine the most tax-efficient structures for their businesses. As a result, many leaders are asking how to re-evaluate the choice of entity and what amount of tax advantage warrants such a fundamental change. There are no simple answers to these questions, but this discussion provides a quick overview of some of the key criteria.

business income taxation in decades. With a new, significantly lower and flattened corporate tax rate, reduced personal rates, and a 20 percent deduction for income from flow-through entities, the act altered several variables in the equations that executives use to determine the most tax-efficient structures for their businesses. As a result, many leaders are asking how to re-evaluate the choice of entity and what amount of tax advantage warrants such a fundamental change. There are no simple answers to these questions, but this discussion provides a quick overview of some of the key criteria.

The “Simple” Math of Business Entity Choice

Many executives are surprised to learn that the new tax rates and the 20 percent deduction are actually some of the less complicated factors to analyze in a choice-of-entity re-evaluation. Here’s a quick review of C-corporation v. flow-through taxation and the effect of the new law on each:

- C Corporations pay an entity-level income tax and income distributed to shareholders is taxed again at the individual level.

Clik here to view.

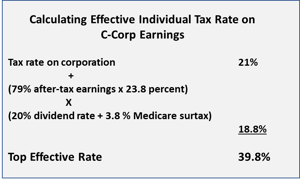

The TCJA significantly decreased the corporate tax rate from a top marginal rate of 35 to 21 percent. As a result, a sole shareholder of a C Corporation that distributes all of its after-tax earnings would face an effective federal income tax rate of approximately 39.8 percent.

- Flow-through entities are not subject to federal income tax at the entity level. All income generated from the business is reported and taxed on the owners’ individual income tax returns.

TCJA did reduce the tax rates on individuals, but the drop was not as significant as the reduction in corporate rates. Top earners went from a maximum rate of 39.6 to 37 percent (40.8 percent once the Medicare surtax is tacked on).

So C Corp seems to be the way to go right? Not so fast…

A New Twist – A Deduction for “Qualified Business Income”

Image may be NSFW.

Clik here to view. Congress also created a new deduction for qualified business income from eligible flow-through entities. The new deduction allows for a deduction of up to 20 percent of qualified income. Owners of a business that qualifies for the full deduction amount could face a top federal effective tax rate of 33.4 percent.

Congress also created a new deduction for qualified business income from eligible flow-through entities. The new deduction allows for a deduction of up to 20 percent of qualified income. Owners of a business that qualifies for the full deduction amount could face a top federal effective tax rate of 33.4 percent.

So who qualifies for this special new deduction?

Unfortunately, the new law has temporarily left us with more questions than answers. What we know at this point (Fall 2018) is that income from businesses in the fields of health, law, accounting, investment management and consulting is not subject to the deduction if it exceeds $157,500 in a year ($315,000 in the case of a joint return).

In addition, a business is ineligible for the deduction if its “principal asset” is the “reputation or skill” of one or more employees and/or owners. The Freed Maxick Tax Team is still awaiting further guidance as to what the lawmakers meant to exclude with this language.

But Wait, There’s More…Other TCJA Provisions that Should be Considered in a Business Entity Selection Evaluation

The rate changes and flow-through deduction are the most obvious changes to the entity choice calculation, but the tax code is full of other provisions that should be considered in a re-evaluation, including:

- Taxes on international income will play a much bigger part in the choice of entity under the TCJA. Businesses with any type of international operations will need to consider the new global low-tax intangible income (“GILTI”) and foreign-derived intangible income (“FDII”) provisions.

- GILTI applies to income generated by a company’s controlled foreign C corporation and creates an additional U.S. tax liability on the overseas profits.

- FDII provides a tax advantage for income generated by a U.S. taxpayer from:

- The sale of tangible property for foreign use, or

- The performance of services for foreign customers where the benefit is derived by a foreign customer in a foreign location.

For a more extensive discussion of these two provisions read our related articles about GILTI here.

- Qualified small business stock (QSBS) treatment may allow individuals to exclude gain on sale of their stock if it meets certain criteria including but not limited to:

a.) acquired as part of an original issue by a domestic C corporation

b.) had no more than $50 million in assets as of the date of stock issuance

c.) engaged in a “qualified trade or business”, examples of certain types of business specifically excluded from the definition of “qualified trade or business” include health, law, engineering, architecture, accounting, consulting, athletics, banking, insurance, investing, restaurants, and hotel/hospitality

State Tax Considerations Regarding Business Entity Selection Choices

Your business cannot afford to forget that state and local taxes play a huge part in determining the tax advantages of a particular entity choice. Depending on where your business operates, the amount and type of activities it performs in those locations, and the applicable tax rates, the impact of non-federal taxes can always sway an entity choice to one side of the fence or the other.

For more insight, observations and guidance on the new Tax Cuts and Jobs Act, visit our Tax Reform webpage.

Stay Tuned

As with many tax discussions the devil is in the details. Given the amount of guidance still to come from the IRS, we don’t even have all of those details yet. Be sure to subscribe to Freed Maxick’s e-mail service for updates as new information becomes available.

Meanwhile, if the issues discussed in this article have you wondering about choosing a business entity and if you need to reevaluate your selection, it’s never too early to start the discussion. Please contact Freed Maxick via our contact form, request a Entity Selection consultation, or call us at 716.847.2651 to discuss your situation.

Clik here to view.